Many experienced health care business owners searching for a succession plan have wrestled with the notion of selling their companies even as they continue to see significant growth ahead of them. Fortunately, there’s an alternative financial technique known as a private equity recapitalization, in which health care business owners can sell a portion of their company to private equity group (PEG) partners and still have the opportunity to benefit from growth.

Private equity recapitalizations, or recaps, offer a unique value proposition that can be a good option for owners looking to take some chips off the table while still being involved in the future of their company.

PEG firms can be savvy business partners that bring more than just capital to the table. They also provide industry, financial, operational and organizational expertise that can be used to increase the value of a business. This is good because if the company’s value increases, a recapitalization also allows owners to profit a second time if the business is eventually sold again.

Fundamentals of a Recap

To gain a better understanding of the recapitalization process, let’s walk through a fairly straightforward scenario.

Mary founded Home Healthcare Co., a Medicare home health care agency, 20 years ago. Home Healthcare Co. has grown throughout the years, but the recent switch to the Patient Driven Groupings Model (PDGM) has made it clear to Mary that too large a percentage of her net worth is tied up in the company. Mary sees the opportunity for continued growth in the company, but also has a need to diversify her wealth and reduce her risk.

Home Healthcare Co. has many good employees who have been loyal over the years and are a big reason for the company’s success. Mary wants to make sure these employees are well taken care of and have the opportunity to continue to lead the company into the future.

After researching possible options and engaging in discussions with other entrepreneurs who have successfully recapitalized their businesses, Mary decides to pursue a PEG recap. Mary finds a partner who wants to invest in Home Healthcare Co.—and who shares her passion for patient care and the vision she has for the future of the company.

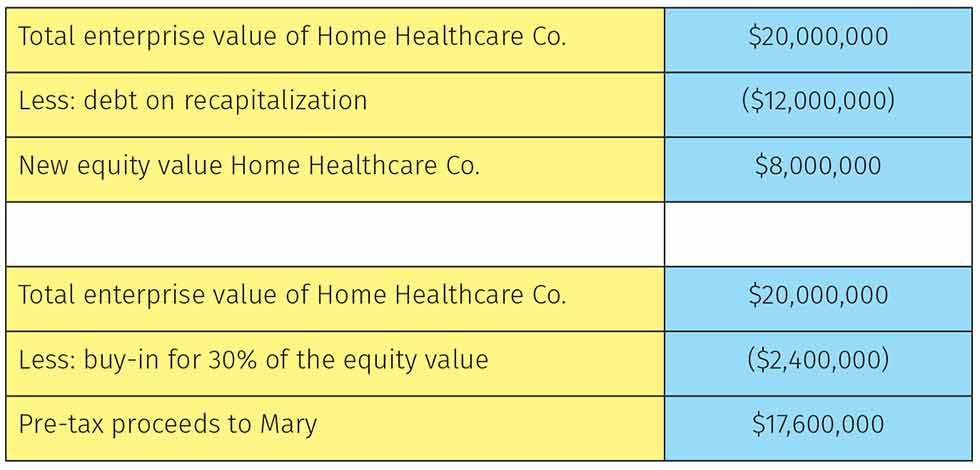

The business is debt free, and both parties agree that Home Healthcare Co.’s negotiated enterprise value (EV) should be $20 million. The acquisition will be financed with 40% equity and 60% debt. After the transaction, Home Healthcare Co. will carry $12 million in debt. Mary will also continue to own 30% equity in the company.

The value of the company’s equity after the recap is shown in Figure 1.

Figure 1: The value of Home Healthcare Co. after recap.

A PEG’s Role

Mary’s company is now considered a platform company, which PEGs typically own for five to seven years. During this period, the PEG will heavily (if not completely) depend on Mary and her management team to operate the day-to-day activities of the company. The management team usually expands quite significantly during this time. The PEG typically will add value by introducing efficiencies that help Mary and her management team perform their work better. These efficiencies can take many forms, from adding technologies to improving process, but, most notably, they will help the company grow through acquisitions.

Most PEGs utilize a growth-through-acquisition strategy, meaning they find and acquire strategic companies that—in this scenario—add value to Home Healthcare Co. These acquisitions can provide new geographical areas, concentration within a market, entrance into a parallel or complementary service or product, or many other possible avenues. The PEG typically handles the transactional function and leaves the post-transaction integrations to Mary’s management team. After the five to seven years have passed, the PEG will execute on a liquidity event for the business, either by selling to another larger private equity firm, to a strategic buyer or through an initial public offering.

It is important to note that Mary does not have a guarantee on the third-party bank debt the PEG utilized to further enhance the gain on the second sale. She also deleverages any risk she may have had with personal guarantees for vendors or payors. Home Healthcare Co. takes on these liabilities itself.

What Partnerships Bring

PEGs typically look to deliver their limited partners (LPs) a three times cash-on-cash return for their investment into the fund. LPs (i.e., stakeholders) can be wealthy individuals, endowments, pension and/or retirement administrators or even corporations. Many PEGs that focus on health care investments like to partner with LPs that also have health care backgrounds.

I was recently performing a recap for a client and we were evaluating which PEGs would be a good fit. We centered on health care-focused PEGs and were evaluating their LPs to see who could add value. The top PEGs all had health care LPs investing in their dedicated fund. In one particular group, the top five investors were United HealthCare, BlueCross BlueShield, Cigna and two very large private hospital systems. As you can see, this drastically changes the opportunities that are available to a platform company.

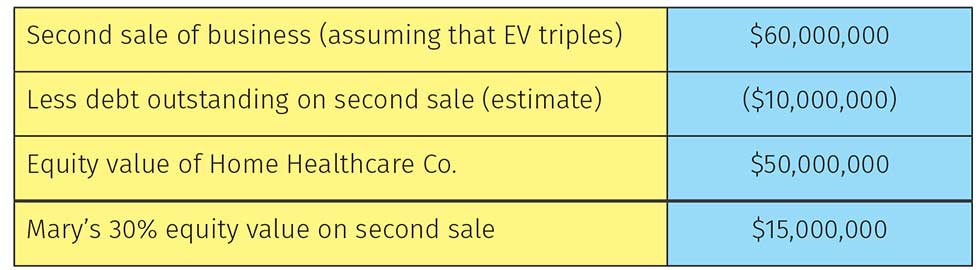

Getting back to our scenario, Mary’s equity value in the second sale—assuming the PEG was able to triple the enterprise value of the business over that timeline—is shown in Figure 2.

Mary walks away with $32.6 million versus the $20 million that she would have earned on the initial sale of 100% of her business. If the enterprise value was to go higher over this time period, which is not an unreasonable assumption given the mandate of most private equity to aggressively grow portfolio companies, Mary would earn even more.

In addition to profiting from the growth, Mary has been able to remain CEO but reduce her role, as a deeper management team has been built around her to take over other functions of Home Healthcare Co.’s operations. The PEG has also continued to assist with executing the strategy, providing board representation and positioning Home Healthcare Co. for a premium valuation on the second exit.

Figure 2: Mary’s profit on the second sale of Home Healthcare Co.

Risks of a Recap

This scenario is a simplistic example with a lot of assumptions, but it does illustrate the potential up side for a recap. As with most things, there are also several down sides to consider, such as:

- The value of the company on the second exit is not guaranteed, nor is the timeline known. There are many variables that could derail these plans.

- After the transaction, Home Healthcare Co. will carry a significant amount of debt. Most business owners are cautious about burdening their company with high debt levels.

- Mary is no longer the majority owner. The PEG will set up an advisory board and empower the management team to drive the business going forward. Most business owners find it hard to relinquish control.

There is a risk of choosing the wrong PEG partner. Business owners must really get to know the PEG and its managers. Additionally, owners will need to confirm the track record of the PEG to determine the likelihood of success.

In my next article, I will discuss how to select the right PEG for your company, and how to make your company desirable on the private equity market.

Bradley Smith, ATP, CMAA, is a former durable medical equipment company owner and is currently a managing director/partner with the international health care M+A firm VERTESS. If you would like to discuss this article, the value of your health care company or practice, or how to get the best price when you sell it, you can reach him directly at (817) 793-3773 or bsmith@vertess.com.