ABENA

Ken Edmunds, Key Account Manager www.abenana.com What are the current trends in the incontinence market? EDMUNDS: One of the more interesting trends is the growth rate of incontinence within the home health market. As we continue to age-in-place with growing success, we are now managing conditions such as incontinence at home versus the traditional setting of long-term care. Running parallel with this is the overall de-stigmatization of this condition as aging trends create more acceptance. What are the current challenges in the incontinence market? EDMUNDS: In the homecare market, manufacturers and retailers alike continue to struggle against the falling reimbursements on incontinence for Medicaid recipients. For many retailers, this was a prime source of income in the past and has forced them to find alternate income fountains to bridge the revenue gap created by this shortfall. There is now a groundswell of interest in developing cash sales on incontinence, but smaller retailers strain to be price competitive. These efforts also force smaller retailers to invest in marketing to help their communities understand that they are viable outlets for these types of products. How can providers educate consumers about incontinence products? EDMUNDS: While popular approaches on education and marketing these days seem to always lean towards social media and other electronic means, we believe the best method is much simpler: talking. Virtually all of the walk-in traffic retailers enjoy are people that are either dealing with incontinence on a personal level or have someone in their immediate family that is living with some form of incontinence. Talking with these people about your product offerings and providing free samples for them or their loved ones will yield results. For those with meager walk-in traffic, advertising in local publications and reaching out via mail are still effective methods. How does marketing incontinence products to men and women differ? EDMUNDS: Now that the market is shifting towards appealing to people living at home, gender-specific products and packaging have become much more prevalent. For incontinence products, there are some obvious differences in the packaging to appeal to the target gender, but there are product design/construction differences as well. In terms of the message, it holds steady for men and women: Our products are designed to earn your trust. How does providing incontinence products help HME dealers realize profitability? EDMUNDS: It doesn’t—at least not unless they are providing the right products and taking the time to promote them in-store and via a steady investment of outreach to local consumers and agencies working with potential customers. Retailers must choose products that are not readily available at lower prices from their competitors, train staff to start discussions with all customers, and develop a strategy to bring in new, walk-in customers.

MEDLINE

Gender Specific Products

Gender Specific ProductsMichelle Christiansen, Vice President Clinical Sales www.medline.com What are the current challenges in the incontinence market? CHRISTIANSEN: Someone suffering from incontinence will go to great lengths to conceal their condition. The person may wear dark clothing, refuse to drink liquids or were fragrances to conceal any odors. Also, be aware of the person trying to double up on disposable absorbent products—two pull ups, two briefs, etc. The person may be experiencing discomfort and have issues with skin irritation from ill-fitting products. A common response to clinically significant incontinence is social withdrawal, which is caused by a fear of accidents and embarrassment. For those who believe their incontinence is severe, there is a good chance they will become anxious and depressed. Anger and hostility are also common among someone with incontinence, and they will usually direct their anger toward the event that led to the incontinence episode or at the caregiver who doesn’t appear to be sensitive to what is happening. What are the opportunities for home health providers in the incontinence market? CHRISTIANSEN: It all starts with communication. If you believe a patient is having a hard time you have to make the time to talk with them about what is going on. Listen closely. Ask questions, such as: What kind of care would you like for us to provide? How much is this affecting your daily activities? What type of product would you be comfortable starting out with? Remember, this is a very sensitive subject and providers have to be careful to not embarrass the patient. Make sure they understand that they are not alone, and that your goal is to make sure they feel confident in the product. All caregivers should be educated on the various types of products that are available today. They should also be taught how to choose the appropriate product. Sizing is also important, so caregivers should have sizing tools readily available. Ill-fitting products are not only uncomfortable for the wearer but they can promote skin breakdown. Also, the type of product and level of absorbency is important. When choosing a product, you have to consider: ease of use/application for the wearer, odor control, fit/comfort and you have to make sure the product is going to keep the skin dry. A comprehensive program can help maintain patient comfort and improve outcomes. That’s why Medline created its Continence Management Program that educates health care workers on moisture management, product selection and application, as well as dignity and management strategies for various types of incontinence. How does marketing incontinence products to men and women differ? CHRISTIANSEN: More people want to remain at home as they age and as a result, consumers have more product choices and stronger preferences. Knowing that incontinence has an emotional impact on those who suffer, Medline strives to preserve an individual’s dignity and comfort. That’s why Medline has developed the brand’s first gender-specific FitRight Underwear for men and women. The women’s version uses nude-colored materials that are more discreet under clothing and the men’s product uses charcoal-colored materials. During product testing, much of the feedback pointed to it having the look and feel of real underwear.

UI MEDICAL

Quick Change Wrap

Quick Change WrapDr. Marion Somers, Clinical Director www.uimed.com What are the current trends in the incontinence market? SOMERS: The incontinence market is in transition on many levels. Universally there is the constant attention to avoiding urinary tract infection (CAUTI) by whatever means is appropriate and available. Institutions and the general public are trying to keep the incontinent individual (male or female) comfortable, confident and informed as to what products are most appropriate. What are the current challenges in the incontinence market? SOMERS: The current challenges are the variety of options a person, or an institution, has to confront these issues of incontinence and the potential complexities regarding care. The incontinence market is expanding as more, different and sometimes complex options become available. In the attempt for a cure, the internal portion of the individual may also be compromised with indwelling catheters, medication, medication reaction or the development of UTI’s. There is also the issue of proper training for staff in the institutional setting or making sure the home environment of the individual is properly prepared for the challenges of dealing with someone with incontinence. How can providers educate consumers about incontinence products? SOMERS: It is a two-fold task. First: Keep the information simple, comprehensive, and in layman's terms without undo medical terminology. Break all information into easy to follow steps. People want to be fully-informed when dealing with any issue that is of primary concern either for themselves or a loved one, but one needs to use caution so they are not overwhelmed or give up on doing things, in the way that will get the best results. Second: Have visual information available, be it brochures, videos, movies or testimonials on a computer screen. Have an area where the individual can pose a question and get an answer to the question on a website. How does marketing incontinence products to men and women differ? SOMERS: My experience is that is it easier for a woman to discuss personal incontinence and it is less comfortable for a man to discuss any part of his anatomy that is not fully functioning. In advertising we have to go with what we already know about the difference in the sexes and acknowledge that the advertising will reflect what society has already dictated or accepted on gender differences. And within the gender lexicon there are yet other variances that might need to be addressed such as the LGBTQ identifications, and their needs may be unique. The QuickChange Wrap (QCW) is primarily for urinary incontinent, bed-bound and non-ambulatory male patients. The product is a brief and catheter alternative. The primary function of the QCW is to capture the urine, keeping the penis dry and urine free. This function keeps the urine from migrating or mixing with fecal matter.

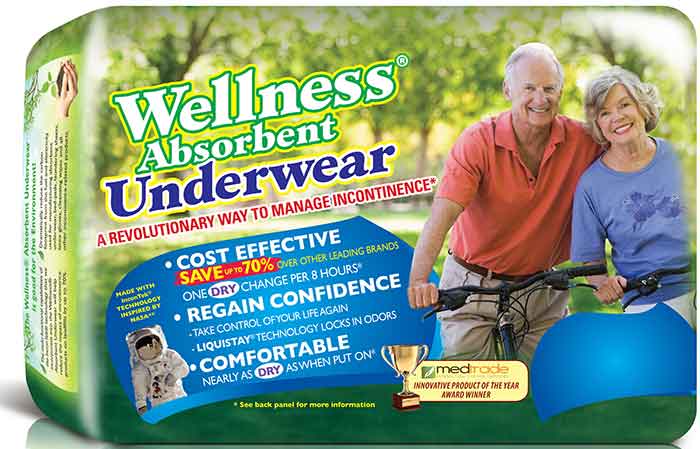

UNIQUE WELLNESS

Steve Goelman, CEO www.wellnessbriefs.com What are the current trends in the incontinence market? GOELMAN: Boomers are now the largest senior population in play, and their tastes are very different from their parents, they want much different product and are looking for premium products. Boomers are, by and large, the wealthiest segment of the U.S. population and therefore unlike the generation before have a much larger amount of people who are not eligible for Medicaid. In light of that, they have to purchase product with cash so the cash market is expanding and growing. What are the current challenges in the incontinence market? GOELMAN: Many consumers still don’t understand that a premium product ends up being more cost-effective than a lesser product because it gets more mileage. This is more of a challenge for DME providers, as more people prefer home delivery than walking into a store. Customers want privacy and discreet packaging rather than walking out of the store with the product. This is hurting the stores. A lot of my products have to be sent discreetly directly to the consumers. How can providers educate consumers about incontinence products? GOELMAN: I think a lot of people look for a product they’ve heard of rather than one that addresses their needs. For example, for someone with heavy incontinence there are pull ups out there, but a tabbed diaper is a better product. Also, some people don’t need to opt for a diaper when they could opt for a pad. And, there are products such as my product that don’t have to be changed that often. If you follow the manufacturer’s directions, the product simply works better. Urologists out there look at the patient’s problem as one overarching problem and just say, “Go buy a diaper,” and don’t look at all the options for what is best for the patient at that time. HME dealers have the opportunity to educate about all possible options. How does marketing incontinence products to men and women differ? GOELMAN: The male and female cuts, and what they claim to address are not that different—it’s a marketing ploy. But, many women feel very uncomfortable in a diaper. They want something that looks and feels nicer. There are companies that make something nicer with a design that provides more dignity for the woman. That’s not something we’ve been focusing on, because it doesn’t affect the function of the product. How does providing incontinence products help HME dealers realize profitability? GOELMAN: Incontinence products are all consumables. When you buy a wheelchair, you buy it once unless it breaks. Incontinence products are purchased weekly or monthly. When you walk into a pharmacy, you have to pass all the other products to get to the consumables. HME companies don’t realize that selling diapers can help move other products out the door. They’ve been focusing on the Medicare and Medicaid reimbursable market and not on cash retail market. If they focus on the growing cash retail, they can get people in the door to buy other ancillary products, too. What are the opportunities for home health providers in the incontinence market? GOELMAN: We have a multi-layered product called, InconTek. We’ve been telling home health agencies they are InconTek certified. They have been using our products to market themselves above other home health providers as keeping patients dry and clean. Home health providers can set themselves apart if they are affiliated with a DME who supplies the products. It takes a headache off the end-user.

TZMO

Seni product line

Seni product lineMihaela Grigore, Chief Operating Officer seni-usa.com What are the current trends in the incontinence market? GRIGORE: We are seeing the diversification of product range and increase of quality; a more personalized approach to continence care; and optimization by mixing the product usage for day and night. Even in the reimbursement market clients are starting to demand that products offered to Medicaid recipients respect a minimum standard of quality recommended by the National Association for Continence (NAFC). What are the current challenges in the incontinence market? GRIGORE: Especially in the institutional environment one of the challenges is changing the facility approach to patient care—the common practice is to use cheaper products and change them every few hours including during the night. Sleep deprivation is another problem people with incontinence deal with because they are disturbed every night to be changed. The solution to this is to use more absorbent, breathable products that will be enough for the entire night and will allow the person to sleep. How does providing incontinence products help HME dealers realize profitability? GRIGORE: Selling a premium-quality brand that is supported by the manufacturer with education and samples, and not available in big boxes stores will help dealers obtain the profitability they need and provide a better care to their clients. What are the opportunities for home health providers in the incontinence market? GRIGORE: Home health providers play an important part in patient care. In many cases they advise the families what the best products are to help their loved one or even take care of the purchase of such products. Knowing what the best products on the market are and being able to advise for the best solution for the particular patient will give them an advantage in front of their competitors. Partnership with brands that will help them with education and free samples is valuable.

ESSITY HEALTH AND MEDICAL SOLUTIONS

TENA Bathing Glove

TENA Bathing GloveScott Meek, National Key Accounts Director, Homecare US and Jenny McGinley, Marketing Director, US essity.com What are the current trends in the incontinence market? MEEK: Breathability has been a buzzword in the market for many years. Today, most incontinence products have some areas that are breathable. The threshold that divides the most innovative companies with all others are the ones that take this technology one step further to not only include the side panels, but all the chassis of the product. This increase in breathable surface area allows for the most important perineal area of the patients to receive the positive effects of the transference of air to the skin while absorbing and retaining fluid and moisture. What are the current challenges in the incontinence market? MEEK: The current and future increase in raw material costs has been a challenge for all incontinent manufacturers. The basic absorbent elements found in incontinence products have seen a steady increase over the last 12 months. This has forced manufactures to seek options to offset this cost. You will find as many different answers to how this cost is being handled as you will find manufactures. Some companies have made a strategic decision to not alter or lower product quality, but rather have timely conversations with distribution and DME partners about a joint solution. Is the increase in product demand built to withstand the price sensitive pressure of market, with the same level of quality, while being reimbursed at a static or decreasing rate? This perfect storm of increased cost and the balance of keeping or improving quality have driven the DME owners to seek out larger global branded partners that provide a consistent product quality at a price that best fits the needs of all layers within the go to market channel. How can providers educate consumers about incontinence products? MEEK: The catchphrase “dual core” has been part of the vocabulary in the industry for many years. A product having a dual core simply means that within the chassis of the product, the manufacturer has created a top layer to pull the fluid away from the body and a bottom layer to trap the fluid within the product. The new innovations hitting the market provides a larger top layer with more surface area to pull more fluid away from the skin and a smaller, more discrete second layer or core to trap the fluid within the product. The dual core with a small and denser second core actually reduces the overall thickness of the product. The thinner product not only performs better from a clinical perspective, but is less noticeable and more comfortable for the consumer. The teaching moment for the provider is to educate the consumer on the fact that technology is now available to increase protection and reduce bulk. How does marketing incontinence products to men and women differ? MCGINLEY: Men typically experience more personal stigma because they have no or little experience in using personal hygiene products in the way a woman does with feminine protection products. As a result, men are less likely to admit that they have a continence issue and seek out product support. Yet, they both want the same things from incontinence products: a good, discreet fit, quick absorption, no leakage, softness, and affordability. Education for both men and women is critical to improving their understanding of how continence products function and how they can actually improve their overall quality of life. How does providing incontinence products help HME dealers realize profitability? MCGINLEY: What makes a customer a repeat shopper? If an individual is incontinent and using product support, they will be a repeat shopper because they will rely on the consistent use of products. Every time the repeat shopper enters the store, the HME dealer has an opportunity to increase the shopping cart value and maximize sales.

PRINCIPLE BUSINESS ENTERPRISES, INC.

Andrew Stocking, PhD, President and COO www.tranquilityproducts.com What are the current trends in the incontinence market? STOCKING: There are two key trends that are creating shifts in the industry. First, the share of the U.S. population over the age of 65 is expected to increase from 15 percent today to nearly 24 percent by 2060. And that population does not want to age in an institution or facility, but at home. As a result, the health care sector is shifting to provide more and better solutions for adults aging at home. Those solutions allow older adults, even those with comorbidities, to be cared for at home just as well as or better than they would have been in a facility. For the incontinence market, that means having highly absorbent and specialized incontinence products available for those with specific needs. Second, we have observed an increasing awareness by caregivers that low cost options tend to be low absorbency products that leave wearers feeling cold and wet. This leads to many more linen changes, skin breakdown, UTIs, and possibly falls if wearers try to go to the bathroom themselves. The costs of all of those effects vastly outweigh the cost of the incontinence product itself. When caregivers think about all of the costs, we see them migrating to higher absorbency products. What are the current challenges in the incontinence market? STOCKING: Over the past several decades, there has been a normalization of discussions about urinary incontinence. We are now hearing more people talk about fecal incontinence and the need for associated products. Recent surveys suggest that as many as 25 percent of adults who experience urinary incontinence also struggle with fecal incontinence. Although there are some products on the market to support those struggling with fecal incontinence, there are more claims than trustworthy solutions. Moreover, the large number of products available for incontinence has made it increasingly difficult for anyone, HMEs, to have fluency in all products in the sector such that they can recommend the right solution for their customers. How can providers educate consumers about incontinence products? STOCKING: The first step has to be learning about the customer’s specific needs so that their consultation is appropriately customized. Dealers can then educate customers on products with various absorbency levels, fit, material types, and discretion, as well as help them understand the differences between the arrays of solutions on the market. Not all products fit the same and we have found that allowing customers to sample different products is a valuable tool in helping customers find the product that best meets their needs. How does providing incontinence products help HME dealers realize profitability? STOCKING: Incontinence products are a growing segment of consumables that can turn one-time purchasers into loyal, recurring customers. In addition, highly absorbent incontinence products attract private-pay customers, which increase margins and reduce overhead costs associated with seeking reimbursements. Furthermore, some incontinence products, like Tranquility, are not offered in big box retail stores, providing HMEs with an exclusive offering for their customers. Each of these factors can contribute to profitability for HME dealers.

MCAIRLAID’S INC.

Rena DeBerry, Marketing and Communication Specialist www.x-top-for-men.com What are the current trends in the incontinence market? DEBERRY: The average weight for U.S. citizens rose “dramatically,” in the CDC’s words, from 166.3 pounds in 1960 to 191 pounds in 2002. Because of this, larger sizes of products with higher absorbency are needed. Customers also want thin products that feel like cloth, not like a diaper. Women prefer reusable solutions such as LunaPad or Always Discreet Boutique. Men want products designed for men such as X-top for men, not just a redesigned feminine hygiene or baby product. What are the current challenges in the incontinence market? DEBERRY: The biggest challenge is having the conversation about incontinence with health care providers too late. Most women start the conversation but won’t elaborate on symptoms. Men wait until leakage becomes so severe they stop doing favorite activities. In either situation, self-esteem is affected and normal activities become unbearable. By waiting to have the conversation, treatment options can be limited. How can providers educate consumers about incontinence products? DEBERY: Two wonderful resources are the Simon Foundation for Continence and National Association for Continence (NAFC). Both are non-profits with the goal of educating the public on the subject of continence. One resource The Simon Foundation for Continence provides are fact sheets ranging from male incontinence to caregiver support. The NAFC provides specific tools for women, men, caregivers and health care providers. All the resources provided at no cost to the consumer. How does marketing incontinence products to men and women differ? DEBERRY: For women’s products, absorbency and feel are key. For male incontinence products, the primary purchaser is a female caregiver. Caregivers are concerned with usage and longevity. They want to know how the product is worn; how much it will hold and how long it will last. Male users want to know about product discretion and security. Men are more conscious of the fact that they are using an incontinence product because unlike women they did not grow up using them. Men want a solution that feels natural and when they use a diaper, shield or pouch they want to know that it will work. They need peace of mind that there is no leakage. How does providing incontinence products help HME dealers realize profitability? DEBERRY: Incontinence solutions is a repeat business with high inventory turn. The products are ideal for auto drop shipments plus, an easy, complementary item to suggest with larger purchases such as wheelchairs, bladder scanners or hospital beds.

TOTAL DRY

Total Dry Fitted Briefs

Total Dry Fitted BriefsDr. Ara Sayabalian, Director of Clinical Services www.totaldry.com What are the current trends and challenges in the incontinence market? SAYABALIAN: There is a focus on brand recognition. What’s challenging is education is lacking on incontinence and how the products work and how to protect the skin. There’s a lot of money being poured into advertising and brand recognition, but not into education or research and development of higher-quality products. How can providers educate consumers about incontinence products? SAYABALIAN: It’s all about risk and risk reduction. There are four units: Providers, users, caregivers and family members. We need to educate them on the reduction of UTIs, falls, and odor and leakage. There are a lot of websites out there that provide this. TotalDry is an expert only in incontinence, and we spend just as much on education as we do on product development. My goal as director of clinical services is to educate on exactly what incontinence means and why education is so important. Incontinence should not mean that you are not able to do the things you want to do. If you can’t, then you are in the wrong products. How does providing incontinence products help HME dealers realize profitability? SAYABALIAN: Incontinence is a highly profitable area for HME dealers because it’s a recurring income stream. It’s up to the dealer to educate themselves and then educate the customer on their needs, especially as the patient’s needs and level of incontinence changes. What are the opportunities for home health providers in the incontinence market? SAYABALIAN: I think assessing the patient is a start. A one-size-fits all approach does not work. If I’m a home health provider, I first need to assess the patient and figure out what kind of incontinence they have, and then I can provide the best product. Everyone in the agency doesn’t need a diaper or pull up. Someone may need a pull up but someone else may need a pad liner.