For many homecare business owners, the past five to 10 years have been a roller coaster in regards to changes in the industry.

The homecare industry as a whole has seen changes that range from newly implemented governmental health plans to technical coding changes with the ICD-10 update. With so many changes happening in the industry, business owners are forced to make adjustments. A major obstacle for many homecare businesses is securing working capital or loans to fund new projects or ventures in order to stay current with industry pressures. Since the 2008 financial crisis, banks and traditional lending institutions have been reluctant to lend to small and mid-size businesses, especially those in the health care space. Due to this lack of lending, a new alternative lending industry has grown, providing businesses in the health care space with working capital and loan products.

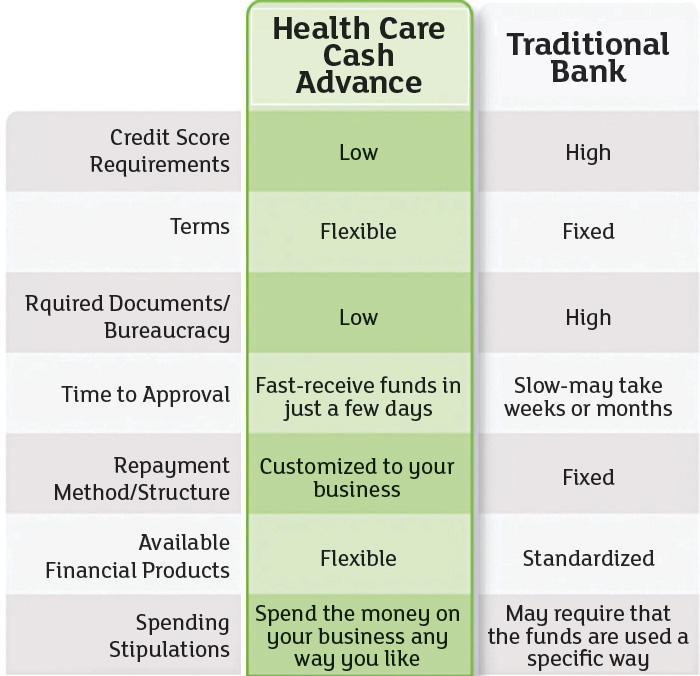

Homecare businesses face financial obstacles that did not exist to this extent 10 to 15 years ago. Many homecare businesses are looking for working capital or business loans that can be used to expand the business, to cover cash flow gaps due to delayed insurance claims, help with taxes that may be due or even to help pay down expenses. Going to a bank to receive this funding is just not practical for many homecare business owners. The bank requires that borrowers put up collateral or secure funding against assets that they own, the application process itself can take a few weeks, the funding process can take up to a month and there is little flexibility in the way in which borrowers can use their funds. On top of all that, the bank looks at a borrower’s credit score as a primary variable in determining eligibility for a loan.

There is an alternative-to-bank funding product in which borrowers can receive non-collateral funding products up to $1 million in as little as two to three business days. Borrowers are free to use this funding how they choose, and most importantly the funding is predominantly based on receivables and cash flow, not just a credit score. This product is called a health care cash advance (HCA) and is a new financial product geared directly toward heath care professionals.

The HCA product is a very simple and easy to obtain product. All that is required to apply is a copy of a single-page application and copies of the previous four business bank statements. The HCA focuses on a business’s cash flows, bank balances and other non-traditional factors such as time in business and volume of EFT deposits to determine eligibility. The way it works is very simple: a business is qualified for an amount that is equivalent to its average monthly revenues. The business owner is free to use that funding however they choose for the business—for expansion, acquisitions, purchasing real estate, covering cash flow gaps, bridging payroll, paying off tax liens— anything that pertains to the business. The terms can be customized to fit current needs, and they range from three months to 18 months depending on eligibility.

The most important thing about this product, and the reason it is health care specific, is the manner in which businesses repay the HCA. With a loan from a bank or traditional lending company, the borrower makes monthly payments toward the principal plus interest. These payments are fixed, whether a business does well that month or does poorly. In this industry, we all know that fluctuations occur due to delayed claims and other factors. With the HCA, product payment is remitted as a pre-determined percentage of future insurance or electronic receivables. Therefore, the funding company would remit a certain percentage of each insurance/private pay receivable until the loan is fully paid off. If there is a day or week when a claim is delayed, the business owner is not required to make a payment until that claim comes in. If there is a month when receivables drop due to the loss of a client or a delayed insurance claim, the payment that month will be lowered to accommodate the fluctuation. If there is a month when receivables and claims were higher than average, then payments for that month will be a little higher.

This product is customizable and can be used for special projects or just general cash flow needs. The cost of the capital is no doubt higher than going through a bank. But business owners can get the funding in a few business days and have the flexibility to use the funding however they choose for their business. This product is not a loan, it is a “purchase of future receivables,” and is priced using a “factor rate” and not an “interest rate.” This essentially means that the HCA funding company would purchase a number of receivables for a certain fixed amount.

It is important to note that this product can be used by homecare businesses of all types and sizes. There are homecare agencies that have excellent credit and monthly revenues that exceed $1 million who use this product as a non-collateralized option for projects and acquisitions. There are also homecare businesses who do as little as $20,000 in monthly revenues but use this product because their credit score is not high enough to get bank funding.

To recap, homecare business owners looking for an alternative-to-bank funding product/loan should seriously consider the HCA product for their capital needs. This product provides benefits that bank funding simply cannot. The credit score requirements for the HCA product are low, the terms are flexible, the required documents are minimal, the funding process can be completed in a few days and the repayment schedule is customized to fit each business’s specific cash flows. The most important benefit is the fact that the business owner is free to use this funding however they choose while bank funding may require that funds are used in a specific way.