Whether you’re a health care business owner seeking to reduce your risk and supercharge company growth or you’re looking ahead to the sale of your business but aren’t ready to give up all your ownership just yet, there’s an alternative financial technique you should know about: private equity recapitalization, also called recap. Recapitalization occurs when health care business owners sell a portion of their business to private equity group (PEG) partners.

This article summarizes how private equity recapitalization works, explains what a post-recap partnership with a PEG can mean to business owners and shares some benefits and risks you’ll want to consider before entering into such a partnership.

Health Care Private Equity Recap

To gain a better understanding of how the recapitalization process works, let’s look at one scenario representing what a health care business owner could expect if they go down this path.

Mary founded Medical Equipment Specialists (MES) 10 years ago. Her Medicare durable medical equipment (DME) company has achieved impressive growth over the past decade and is debt free. Mary has identified several unpursued opportunities for further—and significant—company growth. These include expanding into new markets and adding service lines. However, Mary worries that she lacks the bandwidth, experience and funding to effectively execute those growth strategies. In addition, concerns about the economy and recent market developments have Mary believing that she has too much of her net worth tied up in the company. She is looking for options to diversify her wealth and reduce her risk from having too many of her eggs in this one basket.

MES has a strong staff, including many employees who have been with the company since its early days, and their loyalty is a significant reason the company has achieved its level of success. Mary wants to ensure that whatever decision she makes for the company going forward is not only good for her but also good for these employees.

Through her research and discussions with other entrepreneurs and her merger and acquisitions (M&A) advisor, she identifies recapitalization as the right next step for her business and decides to pursue a PEG recap. With the help of the advisor, Mary finds a PEG with managers who have a shared passion for patient care, believe in her vision for the future of the company, would bring the expertise needed to take advantage of growth opportunities, and, importantly, want to invest in MES.

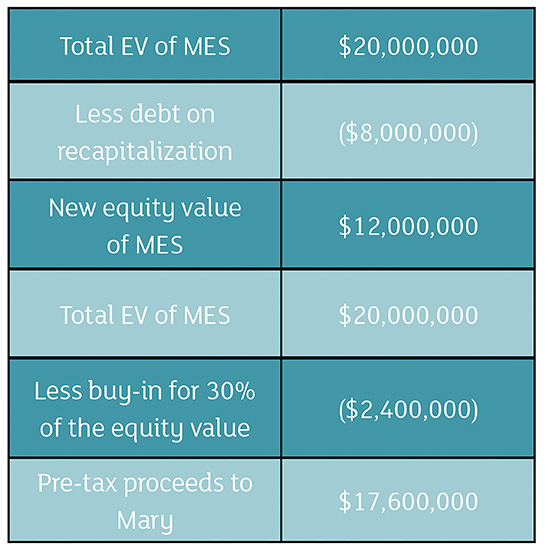

MES’s negotiated enterprise value (EV) is agreed upon by both parties to be $20 million. The acquisition will be financed with 60% equity and 40% debt. After the transaction, MES will then carry $12 million in debt. Mary will maintain 30% of the equity of the company.

A breakdown of the value of the equity following the recap is as follows:

The Post-Recap Experience

Let’s look at what happens to MES now that it has become a platform company for the PEG. PEGs typically hold (i.e., own) their platform companies for five to seven years. During this period, the PEG will heavily—if not fully—depend on Mary and her management team for the day-to-day operations of the company.

But that doesn’t mean the PEG is a passive partner. Rather, PEGs will typically add value in several ways, including: filling in knowledge gaps, adding new expertise and introducing efficiencies intended to help an owner and their management team—which usually expands quite significantly over the recap period—work smarter. These efficiencies can take many forms, but most notably, PEGs will help companies like MES grow through acquisitions.

In this growth-through-acquisition strategy, PEGs go out, find and acquire strategic companies that add value to existing portfolio companies—MES in this scenario. The acquisitions can enhance value by adding geography, enhancing concentration within a market, providing an entrance into a parallel or complementary service or product, or through other possible avenues. The PEG typically handles the transactional function and leaves the post-transaction integrations to the company’s management team. After the five to seven years have passed, the PEG will execute on a liquidity event for the business. This is accomplished through the sale to another larger private equity firm or a strategic buyer or through an initial public offering.

A few important notes: Mary would not have a personal guarantee on the third-party bank debt the PEG uses to further enhance the gain on the second sale. Additionally, she would deleverage any risk she may have had with personal guarantees for vendors or payers. MES takes on these liabilities itself.

PEGs typically look to deliver their limited partners (LPs) a three times cash-on-cash return for their investment into the fund. LPs can be wealthy individuals, endowments, pension or retirement administrators or even corporations. Many PEGs focusing on health-related investments like to partner with LPs that also have health care backgrounds.

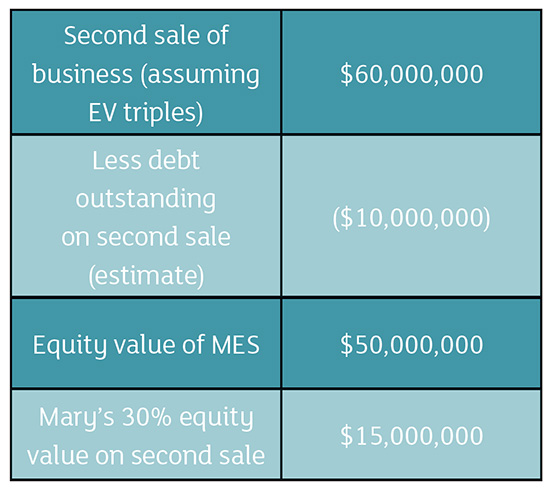

Let’s get back to our MES scenario. If the PEG was able to triple the enterprise value of the business over its timeline and Mary chose this as the time to fully exit her business, her equity value in the second sale of MES, would look like this:

Thus, Mary walks away with $32.6 million ($17.6 million + $15 million)—well above the $20 million she would have earned had she initially sold her entire company. If the EV was to exceed three times over this period, which is not an unreasonable assumption given the mandate of most PEGs to aggressively grow their portfolio companies, Mary would earn even more.

In addition to profiting greatly from her company’s growth, Mary remained CEO but reduced her role thanks to the fuller management team built around her to take over other MES operational functions. The PEG continued to assist with executing an aggressive growth strategy—one that would not have been possible without the PEG’s involvement—and by providing valuable board representation and positioning MES for a premium valuation on the second exit.

Benefits & Risks

Let’s take a closer look at some of the benefits and risks commonly associated with a recap, starting with the benefits:

More money comes to owners. As the MES scenario demonstrated, owners can significantly increase the amount of money earned through the sale of the company in a relatively short period. But they don’t need to exit their business after this initial period. While some may, others remain heavily involved in their companies and support longer-term efforts to further grow value. Owners may be able to gradually reduce their percentage of ownership through additional recaps.

Risk is reduced. Like Mary, most owners of health care organizations have their wealth wrapped up in their company. Considering the volatility we’ve seen in health care and the broader economic markets over the past several years, that can be scary. A single change to Medicare, regulatory requirements, competition, the supply chain—the list goes on—can significantly affect a business overnight. By choosing recapitalization, an owner can keep a meaningful stake and continue to run the business while selling off enough of it to reduce their primary source of risk.

Existing growth strategies can be executed. A PEG brings capital and expertise that can help a company move forward aggressively on growth plans that are being considered or are already in the works, such as adding service lines, upgrading technologies, improving existing processes and opening additional locations.

New expertise is offered. One of the most appealing aspects of working with a PEG is that the group can often provide expertise that was previously missing within the company. This often takes the form of a chief financial officer. Most health care business owners lack a strong financial background—which is critical to making sound growth decisions and investments. The PEG can help fill this and other missing leadership positions.

Acquisitions help achieve growth. A PEG’s growth-through-acquisition strategy can potentially supercharge growth. Consider a DME company that has been recapitalized. This DME company’s PEG may look to acquire a pediatric homecare and/or pediatric nursing company to run alongside the DME company. Such a strategy can open up new revenue streams and different directions for growth the company may not have thought about or been able to execute on its own.

The company can overcome a growth “wall.” I’m working with a company right now that’s owned by two siblings. They took over the company from their father and grew it to almost $20 million in revenue. It’s a great success story. The company has tremendous growth potential, and the owners have identified several worthwhile growth avenues to consider, but they recognize that they’ve hit a wall. They’re not confident in their abilities to execute on the initiatives needed to take their company to $50 million and ultimately $100 million in revenue—or even more. They also lack, and do not want to take out, the significant money that will be required to get them over this wall. They’re looking for private equity partner with the skill and capital to build upon and achieve this growth vision.

It provides for a leadership transition period. A recap provides owners with time to reduce their involvement in daily operations while helping management take on greater responsibility. This can help ensure the company and its clients remain in good hands when owners decide to complete their exit.

Some Risks to Consider

You may lose majority control. A PEG will set up an advisory board and empower the management team to drive the business. Most business owners find it difficult to relinquish control they’ve had for many years and may find it difficult to report to others, possibly for the first time in decades.

It can bring additional work and stress. There are new people involved in the company, including managers. If acquisitions occur, an owner may need to be heavily involved in the integration of the new company and its people. Even the reduction in operations work and stress can bring with it a different kind of stress, especially for those people who enjoyed being in the weeds day in and day out.

New variables will arise. The value of the company on the second exit is not guaranteed, nor is the timeline known. There are many variables that could derail post-recap plans.

High debt can be worrisome. Following a recapitalization, the company can carry a significant amount of debt. Most business owners are cautious about burdening their company and management with high debt levels.

You’ll stay involved in the longer term. A recap requires an owner to remain with the company, usually for at least five more years. You can’t just bank some money and then cruise along for the next few years until reaching a final payday.

There are a multitude of benefits and risks to consider before pursuing a recapitalization, and there are benefits and risks associated with selecting a PEG partner. The right partner can deliver an experience like the one Mary experienced with MES in our example. On the other hand, the wrong partner can overleverage a company with debt, pursue questionable growth strategies, micromanage operations and even cause a business to fail. Work closely with your M&A advisor to get to know the different prospective PEGs and their managers and to confirm the track record of these PEGs to help determine the likelihood of a successful partnership.

Bradley M. Smith, ATP, CMAA, is a former durable medical equipment company owner, a managing director with the international health care mergers and acquisitions firm VERTESS, and a member of HomeCare’s Editorial Advisory Board. If you would like to personally discuss this article, the value of your health care company/practice, or how to get the best price when you sell it, you can reach him directly at (817) 793-3773 or bsmith@vertess.com.