Quantum Rehab

Megan Kutch, MS OTR, Director, Quantum Product Marketing quantumrehab.com

Q6 Edge 2.0 in White

Q6 Edge 2.0 in WhiteTell us about your company.

KUTCH: Quantum Rehab is a global innovator of complex rehab products. Our products are engineered to meet the widest range of needs with functional, durable, stylized, high-performance designs

What trends do you see?

KUTCH: The market focus remains on consumer-inspired innovations for the best possible client outcomes and satisfaction.

Where do you face challenges?

KUTCH: Funding constraints have long been an issue. Yet, as a manufacturer working with providers, our role is to insulate the end user as much as possible and facilitate the outcomes they need.

How is your company staying competitive?

KUTCH: Our iLevel technology allows greater in-home independence and accessibility to aspects such as grocery shopping and navigating crowds. It also has tremendous benefits toward societal inclusion such as maneuvering at standing height and being at eye-level.

What can struggling HME providers do to increase revenue?

KUTCH: Focus on client outcomes and, when it comes to funding constraints, don't assume no is the answer. It is beneficial to explore all avenues of reimbursement and funding.

How does education benefit providers?

KUTCH: The specialty market of complex rehab requires high levels of knowledge and experience. When a provider has these skills, along with a passion to serve others, referral sources take note. The result is that the best client outcomes lead to the best provider outcomes.

Blue Chip Medical Products, Inc.

Blue Chip Medical Territory Rehab Managers bluechipmedical.com

What makes your products stand out in the complex rehab market?

BLUE CHIP: We manufacture quality support surfaces to achieve proper pressure redistribution. Our ability to customize any product allows us to address individual needs of the patient.

Where is the market going in 2016?

BC: The consolidation of the complex rehab market should continue as margins and RAC audits continue to pressure the independent provider. The trend is toward less expensive products to allow increases in established reimbursement and to counteract future cuts to margins.

What challenges do you expect?

BC: The single biggest challenge to complex rehab is that, beginning January 1, 2016, Medicare competitive bid rates will be rolled out to rural communities throughout the nation. In addition to this, complex rehab is losing a carve-out clause for accessories. This will likely drive independent rehab providers towards consolidation.

Where does your company find its competitive edge in this market?

BC: Through investments in quality. Blue Chip Medical Products continues to provide quality craftsmanship in all our products in the face of fierce pressure to reduce costs. The quality of our products provides excellent patient outcomes and reduced service and repair costs for our partner distributors.

Aquila Corporation

Steve Kohlman, President aquilacorp.com

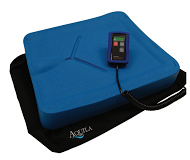

SofTech cushion system with remote control

SofTech cushion system with remote controlTell us about your product line.

Kohlman: We offer an advanced pressure ulcer treatment wheelchair cushion called the SofTech. It is fully automatic and functions in a similar manner to an alternating mattress for the bed. The layout of the internal bladders is customized for each client.

What excites you about this product?

Kohlman: The SofTech cushion is significantly easier for the end user, as it is lighter and can be operated entirely through a remote control.

How is new technology impacting the complex rehab market?

Kohlman: Complicated technology is making it difficult for end users to operate the equipment. These products miss the mark because they do nothing to address the underlying issue of pressure sores. Our cushions work to correct the situation by changing pressure distribution.

Where are the major challenges?

Kohlman: Lower reimbursements. Competitive bidding has a domino effect; it forces more providers out of business, leaving fewer choices for the consumers and more long-distance transactions.

Power Mobility

Natalia Heiland, Business Manager invacare.com

ROVI X3 Powerbase, HCPC Code—E1236

ROVI X3 Powerbase, HCPC Code—E1236Tell us about your products.

Heiland: Invacare's product portfolio includes complex power wheelchairs with a broad range of drive options, specialty wheelchairs and custom manual wheelchairs.

What new technologies are there?

Heiland: Technologies for powered mobility that allow a single access point to drive the wheelchair and perform multiple functions empower people to embark on ventures that were previously deemed impossible. With advancement in technology, accessories are an essential piece of the rehab puzzle and a holistic patient approach.

What is your biggest challenge?

Heiland: Reimbursement. Providers must become billing experts, partner with the clinical community, develop good documentation practices and explore nontraditional sources of funding.

Any new products on the horizon?

Heiland: The ROVI X3 Power Base boasts the narrowest wheelbase in the industry at 23.25 inches, along with easy service access to critical electronic components and strong performance through Active Ride Control (ARC) suspension.

Rehab Products, LLC

Jeromy Havrilla, ATP, VP of Product Development drivemedical.com

Sprout Growable Stroller Base

Sprout Growable Stroller BaseTell us about your company.

Havrilla: Rehab Products, LLC, an affiliate company of Drive Medical, provides ancillary rehab equipment such as car seats, bath seats, bath transfer systems, walkers, gait trainers, activity chairs and specialty rehab items.

How does new technology impact you?

Havrilla: As technology advances in general, you will see the technology of rehab products advance along with it. The rate at which new technology is adopted in rehab will also increase.

How are you staying relevant?

Havrilla: Later this year we will introduce our Sprout stroller mobility base (E1236). It's unique because it has the ability to grow in width. So, unlike other stroller products on the market, it will not need to be replaced as often. This is an important benefit as reimbursement decreases.

How can HMEs stay afloat?

Havrilla: Providers should be looking at all the needs of their customers, and they should also consider looking at new product categories that fit the needs of their customer base.