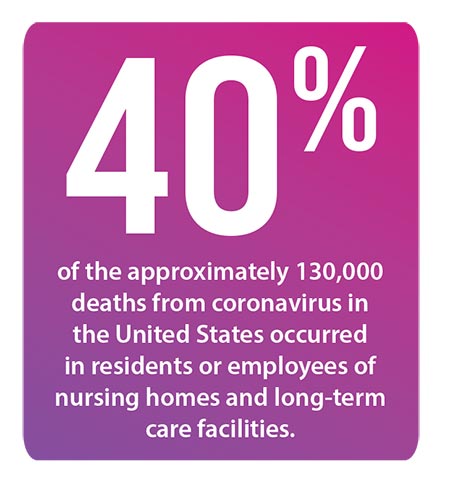

The statistics are brutal—and continuing to rise. An estimated 40% of the approximately 130,000 deaths from coronavirus in the United States occurred in residents or employees of nursing homes and long-term care facilities. One in five such institutions has reported at least one death. And even those left untouched have closed for visitors, leaving residents isolated. One senior in lockdown in a nursing home was quoted by the Philadelphia Inquirer as saying “I feel like I am on death row.”

Even before the pandemic, three-quarters of Americans over 50 said they would prefer to age in place, according to AARP. Others who use and provide homecare—the disability community, people with chronic disease, rural care providers—have long pushed for better remote access to care to protect those vulnerable to infection or limited by transportation issues. Now, it is on the table.

“In a strange way, this pandemic has been sort of a blessing, because it has highlighted the need for addressing issues in the health care system,” David Totaro, head of governmental affairs for BAYADA and chairman of the Partnership for Medicaid Home-based Care, told HomeCare.

So just what does it all mean for the homecare industry? Will there be a sudden demand for more options for care at home? Will home medical equipment (HME) providers and home health agencies (HHAs) buck the trend of small businesses closing as Americans awaken to the value of aging in place?

There are so many questions—and many are impossible to answer six months into a pandemic very few saw coming. But we figured it was time to step back from the day-to-day news about COVID-19 in order to get a sense of how the virus might change homecare after the public heath emergency ends. We asked members of Homecare’s Editorial Advisory Board to peer into their crystal balls and let us know what they think might look different down the road. Here are their thoughts.

Given the pandemic’s toll in institutions, will societal attitudes toward caring for elders at home change?

If there is an up side to the COVID-19 pandemic, it is the increased education and awareness of the critical role durable medical equipment (DME) providers play during a public health emergency. Many providers have been literally on the front lines risking their own lives and those of their families to provide for those in need of respiratory and other medical equipment for those with COVID-19 and/or underlying health conditions at home. The DME industry has shown that with the right medical equipment and technology, people can be treated and have their health care needs managed at home. I am very bullish on the future of DME and homecare as a result of this pandemic. The last place seniors or people with disabilities want to receive care is in a nursing homes or other health care facilities. The future is bright, and policymakers are more aware of the critical role the industry continues to serve.

If there is an up side to the COVID-19 pandemic, it is the increased education and awareness of the critical role durable medical equipment (DME) providers play during a public health emergency. Many providers have been literally on the front lines risking their own lives and those of their families to provide for those in need of respiratory and other medical equipment for those with COVID-19 and/or underlying health conditions at home. The DME industry has shown that with the right medical equipment and technology, people can be treated and have their health care needs managed at home. I am very bullish on the future of DME and homecare as a result of this pandemic. The last place seniors or people with disabilities want to receive care is in a nursing homes or other health care facilities. The future is bright, and policymakers are more aware of the critical role the industry continues to serve.

Seth Johnson, Senior Vice President of Government Affairs, Pride Mobility/Quantum Rehab

Considering the nursing home tolls and fear of infection cutting off families during the public health emergency, HME providers are poised for an untapped opportunity. Families will think twice about placing elders in nursing homes. Consequently, providers can and should help families keep their loved ones comfortable in their own home with the right equipment and assistance. This viable alternative to a group home setting will require an education campaign to help families understand what equipment is available and how to use it, etc. When marketing and educating, include a virtual room setup with staged equipment, similar to the way furniture stores and real estate companies show their products and homes today.

Miriam Lieber, President, Lieber Consulting

With such a high spread in congregate living environments, we’re going to change our way of thinking and the spread of infection. The world is going to approach things in a new way.

With such a high spread in congregate living environments, we’re going to change our way of thinking and the spread of infection. The world is going to approach things in a new way.

Mary Ellen Conway, Chief Compliance Officer, US Med

Things are already changing. Home access companies got a boost in hot spot areas where families removed their loved from isolated senior living environments. The longer Centers for Disease Control & Prevention guidelines are in place in senior living, the more likely that home-based living and care will become more highly utilized. We will stretch the limits of homecare to evolve to be able to take care of nursing home-level needs in someone’s home. I believe the pandemic will affect the assisted living-level client and people will look for residential options.

Jim Greatorex, Vice President, VGM Live At Home

There is no doubt there will be many, many changes in the homecare industry—not only in operations but in discussions at staff meetings. Many discussions will be about staying connected: connection with patients, patients with their families and our ability as providers to stay connected with all those involved in the care plan. Will we be providing smartphones to patients, setting up regular FaceTime appointments and working evenings to meet with families. We also need to focus on staff education, learning about how to keep our patients safe and ourselves.

There is no doubt there will be many, many changes in the homecare industry—not only in operations but in discussions at staff meetings. Many discussions will be about staying connected: connection with patients, patients with their families and our ability as providers to stay connected with all those involved in the care plan. Will we be providing smartphones to patients, setting up regular FaceTime appointments and working evenings to meet with families. We also need to focus on staff education, learning about how to keep our patients safe and ourselves.

Louis Feuer, President, Dynamic Seminars & Consulting

Homecare has distinguished itself in many ways during the pandemic. Caregivers of all disciplines have really stepped up to the frontlines of caring for COVID-19 infected patients while continuing the serve the millions of others who benefit from home care annually. In addition, through significant media coverage, an increased awareness of the value of homecare has emerged in terms of safety, clinical efficacy, convenience and the breadth of services. That awareness has grown in both consumers and the health care community.

Bill Dombi, President, National Association of Home Care & Hospice

So how will long-term life at home look different in the future?

.jpg) I believe that with payers relaxing restrictions and placing an emphasis on telehealth and remote patient monitoring devices, more people will opt for care in their homes versus a long-term care facility. The challenge I see is the need for homecare clinical personnel and custodial care takers. Family members aren’t always able to provide the 24-hour care that is required and a homecare partner is needed. Obstacles include the staffing shortage in homecare and the need for financial assistance for the cost of caring for loved ones in the home. Payers will need to re-look at their coverage criteria to provide reimbursement for custodial care and homecare. Not only is the health care system taxed due to COVID-19, but the baby boomers will also cause an influx to the homecare and long-term care options, highlighting the shortage of caregivers and clinical personnel.

I believe that with payers relaxing restrictions and placing an emphasis on telehealth and remote patient monitoring devices, more people will opt for care in their homes versus a long-term care facility. The challenge I see is the need for homecare clinical personnel and custodial care takers. Family members aren’t always able to provide the 24-hour care that is required and a homecare partner is needed. Obstacles include the staffing shortage in homecare and the need for financial assistance for the cost of caring for loved ones in the home. Payers will need to re-look at their coverage criteria to provide reimbursement for custodial care and homecare. Not only is the health care system taxed due to COVID-19, but the baby boomers will also cause an influx to the homecare and long-term care options, highlighting the shortage of caregivers and clinical personnel.

Sarah Hanna, CEO, ECS North

Daily check-in meetings with patients may be in order as we see reductions in our staff as they work to meet their own personal challenges. Children not in school full-time can alter the roles of our homecare workers. It is hard to believe that the school system will impact our homecare industry, but it will. It is hard to be a nurse full-time visiting seven or more patients a day when you are concerned about helping small children with their education at home.

Louis Feuer, President, Dynamic Seminars & Consulting

We will continue to see the growth of products, services and technologies that will allow the elderly to remain in the home while being monitored by family members, other caregivers and providers. Initially, many of these products, services and technologies will be “cash pay.” Over time, as third-party payers recognize the cost savings that come with people “aging-in-place,” they will cover them.

Jeffrey S. Baird, Chairman, Health Care Group, Brown & Fortunato P.C.

Aging in place will get more lip service once the dust settles and people welcome services in the home again. The home access industry as a whole is down about 25% in 2020, and any projects that take more than half a day to complete are down over 50%. This industry has had double-digit growth for a few years now; post COVID-19, we will have a backlog of need to address and more emphasis on the home setting. We expect lots of investment in technological advances in senior home automation and home safety upgrades in the next three years. Look for lots of voice-activated solutions and other senior-friendly technology and attractive home safety upgrades with a less institutional look. I believe that if we really want aging in place to be a “real thing,” we need positive public policy that will encourage homeowners to invest in home safety via tax incentives. Keeping people in their homes is most times the winning answer. It’s where they want to be, it’s certainly the most cost effective and in our current public health environment, it’s the safest.

Aging in place will get more lip service once the dust settles and people welcome services in the home again. The home access industry as a whole is down about 25% in 2020, and any projects that take more than half a day to complete are down over 50%. This industry has had double-digit growth for a few years now; post COVID-19, we will have a backlog of need to address and more emphasis on the home setting. We expect lots of investment in technological advances in senior home automation and home safety upgrades in the next three years. Look for lots of voice-activated solutions and other senior-friendly technology and attractive home safety upgrades with a less institutional look. I believe that if we really want aging in place to be a “real thing,” we need positive public policy that will encourage homeowners to invest in home safety via tax incentives. Keeping people in their homes is most times the winning answer. It’s where they want to be, it’s certainly the most cost effective and in our current public health environment, it’s the safest.

Jim Greatorex, Vice President, VGM Live At Home

Homecare is likely to involve a greater degree of integration with physicians during the homecare episode and with other health care sectors prior and subsequent to the homecare episode. Technological connections to patients and other health care providers will be a big part of that integration. It differs from today and 2019 in terms of the willingness of the physicians and other health care sectors to be part of that active integration stemming from an increased respect for the value of care at home.

Bill Dombi, President, NAHC

How might telehealth, remote care and/or remote customer service and equipment servicing change the way the industry functions?

This is another big opportunity within the industry that could truly revolutionize health care as we know it. Telehealth has proven to be a viable option during the pandemic. The prevalence of its use, and evaluation thereof, is already resulting in signals from policymakers that the temporary relief that expanded telehealth and remote care services should be made permanent, rather than expire at the end of the PHE. Quality of care has not been an issue with telehealth or remote care services and broader use would open up the door for even more efficiencies within the health care continuum.

Seth Johnson, Senior Vice President of Government Affairs, Pride Mobility/Quantum Rehab

_cp.jpg) In addition to telehealth visits by health care professionals, HME providers will remotely train customers on the proper use of their devices. Moreover, they will troubleshoot remotely in lieu of in person service calls. With technology like FaceTime (provided it is HIPAA compliant), a provider can tour a client’s home before sending equipment. This should save considerable time and money for the HME provider and reach customers who would otherwise be unreachable, particularly in remote rural areas.

In addition to telehealth visits by health care professionals, HME providers will remotely train customers on the proper use of their devices. Moreover, they will troubleshoot remotely in lieu of in person service calls. With technology like FaceTime (provided it is HIPAA compliant), a provider can tour a client’s home before sending equipment. This should save considerable time and money for the HME provider and reach customers who would otherwise be unreachable, particularly in remote rural areas.

Miriam Lieber, President, Lieber Consulting

Over the last 20 years, third-party payers have been pushing health care providers away from the traditional fee-for-service model and towards the collaborative care/patient outcomes model. This push has been driven by the need to control costs, which includes keeping patients out of the hospital. Commercial insurers have been much quicker than Medicare/Medicaid in paying for telehealth. The pandemic has brought the issue of telehealth to the forefront. At the end of the day, can a patient receive adequate health care without having to engage in a face-to-face encounter with a provider? The short answer, in many cases, is yes. During the pandemic, Medicare and Medicaid have relaxed a number of restrictions. Many of these relaxed restrictions will remain in place after the pandemic.

Jeffrey S. Baird, Chairman, Health Care Group, Brown & Fortunato P.C.

While the pandemic has given added energy to technology-based services in the home, telehealth, remote patient monitoring, and patient services through telecommunications have been a key part of health care at home for over two decades. The current surge in health care policy reform in favor of telehealth can be expected to continue with many of the COVID-19 waivers and exceptions finding a permanent status in Medicare, Medicaid and other payers. This will allow for a better use of professional resources in homecare at a time of growing demand for care in the home and a shrinking pool of caregivers. Still, telehealth is a tool for health care professionals, not a clinical service itself. As such, home health care and hospice can be expected to continue as primarily a set of in-person services with supplemental support through telehealth. Physician and non-physician practitioner services should become more integrated with these home-based cares through the practitioners’ use of telehealth to form a stronger team in home health and hospice care.

Bill Dombi, President, NAHC

We’ve been looking at telehealth and wondering why Medicare has been so slow to accept it without so many limitations. But now the pandemic has required it be adopted very quickly and in a simple way. Hopefully it will remain in place long term.

Mary Ellen Conway, Chief Compliance Officer, US Med

Who will thrive in a post-COVID-19 world? Will there be mass consolidation?

In the DME world, we are already seeing a great deal of consolidation. Several of the large players are purchasing medium and small players. And we are seeing mid-sized players purchasing other mid-sized players and smaller players. This consolidation will continue. In my opinion, the only way that a small DME supplier can compete against a national supplier is for the small supplier to (i) provide personal service and (ii) advertise the fact that it provides personal service. Approximately 70% of Medicaid patients are covered by Medicaid Managed Care Plans and approximately 35% of Medicare patients are covered by Medicare Advantage Plans. These percentages are increasing. It will be important for DME suppliers, large and small, to be added to as many plan panels as possible. It will continue to be a challenge for DME suppliers to survive based on third party reimbursement. As such, it will be important for suppliers to expand into the cash market. In doing so, they will have to compete with Amazon. Most suppliers cannot compete with Amazon based on price. However, the suppliers can easily compete with Amazon on after-sale service.

In the DME world, we are already seeing a great deal of consolidation. Several of the large players are purchasing medium and small players. And we are seeing mid-sized players purchasing other mid-sized players and smaller players. This consolidation will continue. In my opinion, the only way that a small DME supplier can compete against a national supplier is for the small supplier to (i) provide personal service and (ii) advertise the fact that it provides personal service. Approximately 70% of Medicaid patients are covered by Medicaid Managed Care Plans and approximately 35% of Medicare patients are covered by Medicare Advantage Plans. These percentages are increasing. It will be important for DME suppliers, large and small, to be added to as many plan panels as possible. It will continue to be a challenge for DME suppliers to survive based on third party reimbursement. As such, it will be important for suppliers to expand into the cash market. In doing so, they will have to compete with Amazon. Most suppliers cannot compete with Amazon based on price. However, the suppliers can easily compete with Amazon on after-sale service.

Bradley Smith, Managing Director/Partner, VERTESS

H ome health care has demonstrated for decades that it can handle pressure as well, if not better than any other health care sector. Home health care has faced many challenges over the years, from arbitrary claim denials to irrational payment models to staff shortages to “bad actor” incidences involving health care fraud. The outcome has been the strengthening of home health care and the expansion of its place in health care. The challenges of the pandemic have been daunting, but the outcome to date has been another step forward in the value of home health care. To thrive in health care, and particularly home health care, one must be ceaseless in exploring innovation, tireless in employing creativity, and willing to roll with the punches that inevitably come when you challenge institutionalized health care powers. That all translates to a willingness to not only embrace change, but to lead it. Home health care has been consolidating for many years while also growing organically. That will continue for a number of reasons, particularly because home health care is not burdened by the costs of bricks and mortar.

ome health care has demonstrated for decades that it can handle pressure as well, if not better than any other health care sector. Home health care has faced many challenges over the years, from arbitrary claim denials to irrational payment models to staff shortages to “bad actor” incidences involving health care fraud. The outcome has been the strengthening of home health care and the expansion of its place in health care. The challenges of the pandemic have been daunting, but the outcome to date has been another step forward in the value of home health care. To thrive in health care, and particularly home health care, one must be ceaseless in exploring innovation, tireless in employing creativity, and willing to roll with the punches that inevitably come when you challenge institutionalized health care powers. That all translates to a willingness to not only embrace change, but to lead it. Home health care has been consolidating for many years while also growing organically. That will continue for a number of reasons, particularly because home health care is not burdened by the costs of bricks and mortar.

Bill Dombi, President, NAHC

I believeretail outlets, backed by a strong e-commerce offering, will be a huge factor in homecare. As the Medicare benefit continues to deteriorate, I expect consumers to buy homecare solutions at the quality they want. The HMEs who develop a good quality product offering at affordable pricing, can execute orders and not lose all their margin to freight costs, and innovatively market themselves will find success.

Jim Greatorex, Vice President, VGM Live At Home