Sponsor

The walk-in tub and shower market is experiencing major growth. According to Verified Market Reports, the global walk-in shower market was valued at approximately $1.5 billion in 2024 and is projected to reach $2.8 billion by 2033. The report estimates the market will grow at a compound annual growth rate (CAGR) of 8% to 9%over the next 5 to 7 years. What began as a niche solution for limited mobility has evolved into a mainstream component of home health care and aging-in-place strategies.

This growth isn’t driven by luxury or convenience but by deeper underlying factors:

1. Demographic Shifts: Older Population Choosing to Stay Home

According to a recent AARP survey, nearly 90% of adults over age 65 want to remain in their current homes as they get older. Another study found that 84% of older Americans consider aging in place a priority, and 88% of those 65+ already own their homes. This clearly supports the trend toward staying in home settings as people age.

2. Care Delivery Moving Upstream & More Care at Home

A McKinsey report from early 2022 projected that as much as $265 billion in Medicare-covered services could shift from facilities to home by this year, potentially moving 25% of related care to home settings. More recent expert analysis notes a significant shift from traditional acute-care sites to alternative at-home settings, driven by value-based care, technology and payer incentives. These trends validate the upstream movement of post-acute and chronic care into the home environment.

2. Regulatory & Reimbursement Support

Medicaid waivers and VA funding increasingly support home modifications such as accessible bathing, and while funding varies by state, these programs are expanding. Additionallythe Center for Medicare & Medicaid Services’s (CMS) Transforming Episodic Accountability Model (TEAM) (launching in January 2026) and other value-based reimbursement frameworks are explicitly designed to encourage care transitions to the home. Broader adoption is also driven by aging-in-place initiatives, including accessibility grants and universal design programs aimed at reducing health-related risks in residential environments.

For homecare professionals, remodelers, clinicians and care managers, this trend demands attention: Walk-in bathing systems are no longer an optional upgrade—they are becoming essential clinical tools.

Why the Surge Is Happening Now

Several key forces are fueling this market expansion:

1. Aging-in-place becomes standard care.

According to a 2024 AARP survey, 75% of adults aged 50+ want to remain in their current homes long-term, yet fewer than 5% of U.S. homes are equipped with the necessary accessibility features. This highlights the urgent need for safe bathing solutions to support independent living

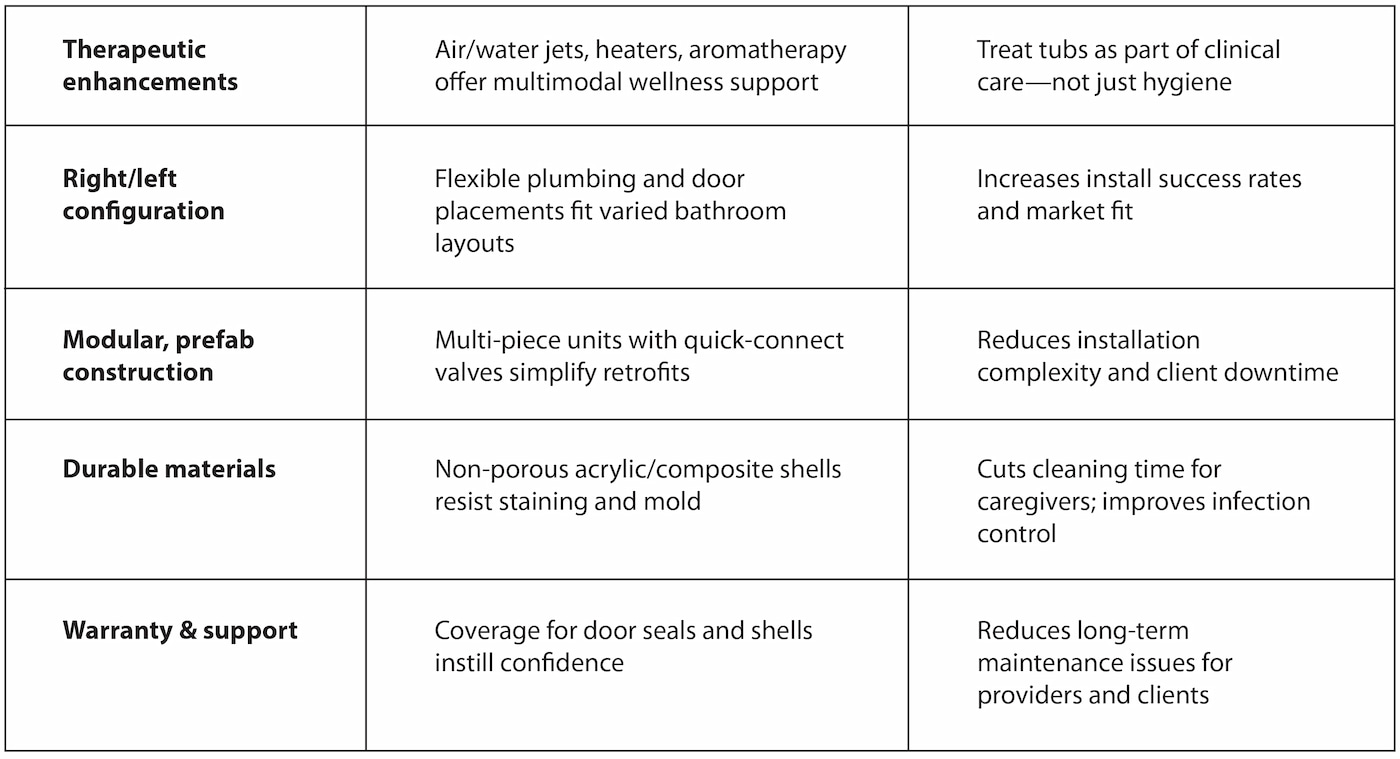

2. Design evolution drives adoption.

Contemporary tubs feature low thresholds, ergonomic seating, grab bars and faster fill and drain capabilities, which help eliminate previous barriers such as bulk, complexity or stigma.

3. Therapeutic integration adds value.

Features like hydrotherapy jets, seat warmers, chromatherapy, aromatic infusion and ozone sanitization offer holistic benefits by supporting circulation, pain relief and comfort.

4. Funding mechanisms improve access.

Home modification programs through Medicaid waivers, Veterans Affairs funding and aging-in-place grants support these installations, expanding access beyond out-of-pocket financing.

5. The installer ecosystem matures.

Many walk-in tubs are now modular and designed for relatively rapid installation, minimizing downtime and installation challenges.

These forces are not short-lived; they are reshaping how we think about residential bathing.

What This Boom Means for Homecare Professionals

1. Bathing becomes a clinical intervention.

Properly selected walk-in tubs reduce fall risk, enable better personal hygiene, improve wound care and lessen caregiver strain during assisting.

2. Client expectations get elevated.

Once considered a clinical necessity, these solutions are now expected to offer dignity, comfort and aesthetic integrity; clients demand more than bare functionality.

3. New partnership dynamics emerge.

Coordinated care across health care disciplines, durable medical equipment (DME) suppliers, remodelers and case managers becomes the norm as it requires shared specifications, scheduling protocols and training.

Business opportunity expands

Bundled service models—assessment, install, support—can enhance care outcomes and sustainability. With proper clinical justification, reimbursement via grants or insurance becomes more feasible.

Key Trends to Monitor

Common Pitfalls in a Changing Market

While growth brings opportunity, it also brings risks:

- Not all walk-in tubs are equal: Some consumer-grade models lack Americans With Disabilities Act (ADA) compliance, seat ergonomic support or professional-grade materials.

- Design-forced installs: Without clinical guidance, features like inward-opening doors or inadequate seat height can compromise safety and usability.

- Poor installation can negate benefits: Placing these tubs in homecare without proper planning (floor reinforcement, drainage adjustments, ADA-compliant grab bar placement) may undermine their effectiveness.

- Over-engineering for the task: Features like chromatherapy or jets are beneficial—but only when aligned with actual client needs (e.g., chronic pain vs. post-op care).

Recommendations for Future-Ready Providers

Prioritize clinically aligned bathing products: Ensure options include ADA-compliant models, flexible configurations, ergonomic seats, antimicrobial materials and certified safety testing.

Require technical documentation in purchasing decisions: Request job-pack spec sheets, CAD/Revit models and manufacturer installation vetting documentation to guide fitting and placement.

Train stakeholders to evaluate bathing safety features: Provide OTs, installers and case managers with the knowledge to evaluate key safety elements such as threshold height, seat design, door swing direction, and drainage setup during home assessments.

Integrate bathing solutions into care pathways: Prescribe walk-in tubs like durable medical equipment. Tie them to fall prevention, wound care and quality-of-life metrics to unlock funding.

Use market growth data to justify funding: Reference the projected $2.5 billion market growth and 8–9% CAGR to demonstrate widespread adoption and make a stronger case for grants or agency support.

A Strategic Imperative, Not a Feature Upgrade

The walk-in tub market is a clinical evolution, not just a fad. Between 2023 and 2033, this segment’s projected near-doubling signals a broader shift in how we define safe, effective home care.

Embracing this shift means:

- Delivering better outcomes: fewer falls, stronger hygiene, improved rehab adherence.

- Preserving dignity for clients with comfortable, accessible bathing.

- Coordinating efforts between clinicians, installers, and funding sources.

- Improving operations with streamlined install and durable performance.

When walk-in tubs are selected with clinical intent rather than treated as decorative add-ons, they become powerful tools for safety, health and independence. That is what true care innovation looks like.