Consolidation in the HME/DME billing software market reflects the consolidation in the provider market during the last several years. Both are driven by regulatory changes and the cost of adapting. In the case of software suppliers, the combined effect of higher compliance costs and a shrinking customer base has led to several acquisitions, most of them by industry leader Brightree. The software vendors who remain continue to help providers build efficient businesses and respond to the changing market. Emergence of new health care trends such as managed care systems and efforts to create a paperless environment are providing new challenges—and opportunities—as software vendors help providers cope. Specifically, the hurdles of implementing Medicare’s new ICD-10 codes for diagnoses and medical procedures, among other compliance issues, are challenging software providers and their HME/DME customers in 2014.

Creating Efficiencies

With its clients representing about 36 percent of the DME market, Brightree offers cloud-based software products serving post-acute care markets, including home health care and hospice, as well as DME/HME. The company is also rolling out an HME pharmacy solution that extends the Brightree platform to fulfill prescriptions and bill for medications in addition to managing HME supplies. In January 2013, Brightree acquired CareAnyware, a clinical and billing software solution provider for home health agencies and hospice organizations. In November 2013, Brightree acquired MedAct and added 330 customers to its ecosystem. The company will continue to support the MedAct software solutions and will give providers the option to stay on their current platform or move to Brightree. Previous Brightree acquisitions include Computer Applications Unlimited (CAU) in 2010 and Pacware in 2011. Adapting to regulatory changes requires dedicated personnel, and Brightree has 15 people “working day and night on changes in our software,” says Chris Watson, chief marketing officer of Brightree. In addition to adapting to regulatory changes such as ICD-10, Brightree is looking to help providers create even more efficiencies in the challenging, lower- reimbursement environment. Watson says they will invest $80 million in software development in the next four years. With three new software releases each year, some providers struggle to take advantage of all of Brightree’s new features, Watson says. Brightree has a team of account managers who work with customers to help them implement the new enhancements and make sure they are leveraging everything in the system. For smaller providers, there is probably room for about 40 percent improvement; for larger companies, the margin is around 20 percent, Watson says. While larger companies may have more IT resources, smaller providers are often hungrier for improvement, nimble and have less existing infrastructure to slow down technology improvements. In addition to creating efficiencies, Brightree is introducing functionality to drive new business to customers. For example, the company has signed an agreement with Athena Health, a physician practice management software company, to create a referral management feature to send referrals electronically to Brightree HME/DME customers. “You’ll hear a lot about Brightree helping to drive referrals and new business,” Watson says. Interoperability is also in Brightree’s crosshairs, given the new health care data-sharing environment. Brightree’s presence in the hospice market is an opportunity for customers to exchange data in a prime market if they are looking to diversify away from Medicare. Brightree also now has an HL7 interface to enable data exchanges with hospital information services such as McKesson, Cerner and Epic. The HL7 engine will allow providers to access orders from hospitals or other referral sources, which takes the time and human error out of the data entry required with paper- or fax-based referrals. Interoperability will change how providers work in 2014, Watson says. Brightree’s Connect Platform, which works with the core billing engine, promotes automated contact with patients. The platform enables providers to reach out to patients who are eligible for resupply, either by an automated call, a guided manual call or an email. The system can confirm a resupply order without speaking to the patient. The no-touch workflow approach cuts resupply labor, and one provider customer realized a 38 percent increase in resupply revenue. Brightree’s core product now has a payer-products rules engine, which allows a provider to input rules—based on individual payers—to help decrease or eliminate denials. “Automate as much as possible,” Watson recommends. “Be sure your underlying system is based on intelligent data embedded in the system. Make sure your software vendor is committed to investing in the future of health care IT.” She says providers should also be attentive to changes in the industry, such as outcome-based reimbursement models, managed care organizations and increased data sharing across industry sectors. Systems that capture and share data can help demonstrate the value of DME and allow the DME to know the status of each patient and confirm they are meeting patient needs.

Patient Intake

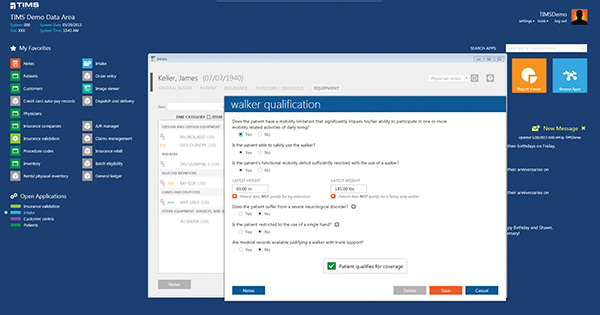

Computers Unlimited (CU) offers either on-premises or hosted software solutions. Dan Greyn, who handles systems sales for Computers Unlimited, says he is seeing smaller users migrating toward hosted cloud-based solutions, while larger players, including those that are affiliated with larger hospital systems, often prefer a system to run off a server at their premises. Often viewed primarily as a billing system, the Total Information Management System (TIMS) platform from Computers Unlimited is actually a complete business enterprise resource planning (ERP) system, including integrated inventory, purchasing, accounts payable, etc. TIMS software is used primarily by large and medium-sized HME/DME companies, and the average number of users is around 80. Customer size ranges from a small company with seven or eight branches up to the largest HME/DMEs. CU’s largest customer has more than 1,000 users, while its smallest only has nine. During the last year, CU has been rolling out its Patient Intake application, which helps providers implement billing rule requirements upfront at intake. “They have to know when they dispense the product that they will be paid for it,” says Greyn. “Patient intake is the revenue source. Our focus has been on gathering supporting documentation.” Each insurer has specific requirements to qualify patients for HME equipment, and the TIMS intake application makes sure requirements are met when the equipment is dispensed, whether it is a certain saturation rate for an oxygen patient or a situation that would justify an electric versus a semi-electric hospital bed. Previously, knowledge of the range of documentation requirements of various payers depended on tribal knowledge in a company, a spreadsheet or a sticky note cheat sheet in the intake area. Now, the Patient Intake application incorporates documentation requirements and can warn an HME/DME upfront to get an ABN if the insurance won’t pay. One client beta-tested the application at seven locations and saved approximately 140 hours per month in labor, or almost a full-time equivalency (FTE) in labor savings. Greyn says providers should base software purchase decisions on a thorough evaluation of whether a certain product fits their needs—not just on advertising and marketing. No product does everything for everybody, so clients should look at their priorities and how a software product fits with the largest part of their business. Providers should also do their due diligence and ask the tough questions. Does the product really fit the needs of the company? “We look for clients we play best with, and we’re not afraid to say if we aren’t a fit for them,” Greyn says.

Automation

Like other software providers, Mediware is focusing currently on upcoming ICD-10 regulatory requirements, says Kimberly Commito, director, product management, Mediware Information Systems Home Care Solutions. Mediware provides software solutions to core areas of home health care, including DME/HME providers as well as home infusion and specialty pharmacy providers. The company seeks to help home care organizations automate aspects of their business related to documentation, effective referral management, service delivery, inventory control, billing and accounts receivable. The solutions can be installed on premises or accessed via the Internet in a hosted environment. (Mediware acquired Fastrack Health care Systems earlier this year.) The company is also working to develop a new product that will bring together its various software solutions into a single platform that includes HME/DME, home infusion and specialty pharmacy, or any combination. Mediware’s mobile delivery applications incorporate electronic signature capture for delivered products, as well as mobile data collection to increase efficiencies when providing service in the patient home environment. There is no duplication of data entry. Services delivered to a patient are carried seamlessly through the billing process, producing standard electronic claims for processing with all the industry clearinghouses such as Emdeon and ZirMed.

Computers Unlimited Total Information Management System (TIMS)

Computers Unlimited Total Information Management System (TIMS)Commito emphasizes the importance of being able to report activity within an application. An example is quantifying the number of claims processed through an automated system versus manually. Also, tracking and reporting the number of denials over time can supply a DME/HME provider an indicator that automation is successful if the incidence of denials based on inaccurate claim information decreases. For example, the ability to track required billing documentation such as Certificates of Medicare Necessity, prior to releasing a claim for processing, could lead to higher incidence of paid claims over time. Mediware solutions offer open SQL architecture and/or report writing capabilities to provide data to continually manage and support the health and growth of the business. Automation can lead to cleaner claims and shorter DSOs by virtue of getting a claim processed the first time versus being rejected by the reimbursement source. However, Commito says that software is just a tool. “Tools must be well-maintained to work appropriately, and software is no different,” she says. “Maintenance requires thoughtful configuration of the software solution, upkeep and implementation of enhancements as they are made available, and careful management of the data being captured.” Changing Provider Mix In business since 1989 and embarking on its 25th anniversary, Noble House has watched the industry transition from a business dominated by mom-and-pop stores to one with a more corporate mentality with larger players. Richard Mehan, president of Noble House, says the transition to larger customers has led them to use more features of the software. The Noble House system is an installed client-server application (not a hosted environment). Mehan says that a hosted environment is not the best fit for all customers. “We are finding that the larger customers are more inclined to want to control their data and have it in-house rather than a hosted solution,” he says. Noble House is provider of Noble*Direct billing software, in which data flows seamlessly from patient intake through billing, Mehan says. Noble House can submit documentation electronically, which is useful given the increase in audits. The capability is being embraced as CMS seeks to use the Internet and automate the flow and processing of documentation with providers. In general, health care billing is moving toward a paperless environment with more carriers accepting claims electronically, Mehan says. “I just think the ease of use of our software has made subtle changes just a natural extension of the user’s experience,” Mehan says. He says Noble House seeks to be proactive in adapting to any change CMS implements. One example is requirement of the new CMS 1500 form, a standardized form for claims that are not submitted electronically, which goes into effect Jan. 6 with a drop-dead date of April 1. Another hurdle is the new ICD-10 diagnostic codes, facing a deadline of Oct. 1, 2014, unless CMS delays it. “Our goal with existing customers is to implement a process to assist the provider in converting their patient-based codes from ICD-9 to ICD-10 when possible,” Mehan says. If automatic processing is not possible, the system assists providers to reach out to physicians to clarify the new codes. A three-person internal team at Noble House has been reaching out to customers during the last couple of months to share how the software will adapt to the ICD-10 hurdle. “It’s an example of how we are proactive helping providers continue to respond to challenges presented by CMS,” Mehan says. He says that approximately 30 percent of customers didn’t even know that ICD-10 was coming. “Even though it’s still 10 months away, the clock is ticking,” he says. Mehan predicts that the reemergence of the PECOS issue at the beginning of the year will cause problems for providers. He says one of his company’s larger customers shared that a big percentage of its doctors are not enrolled in the PECOS (Provider Enrollment, Chain and Ownership System) database, which will affect reimbursement. Noble House is incorporating information about whether doctors are registered in normal usage of the software, which will provide an alert if a physician isn’t enrolled. Noble House is also looking to address changes in the DME business as providers seek other avenues of revenue, providing software to adapt to those new revenue sources. Providers should “make sure the software they are looking for is capable of adapting to their internal flow and processes,” Mehan says. Software can also assist providers to create a flow and process to streamline their operations. Sometimes in a functioning business, there is resistance to making changes, he says.

System Needs

QS/1 Data Systems’ SystemOne HME software keeps up with the documentation for audits and provides electronic billing for all four DMAC regions and state Medicaids through Ability and ZirMed. The system is programmed to identify if information is missing, which ensures faster payment. The software can handle rentals and maintenance records, and QS/1 is in the process of adding the new ICD-10 codes. Other features include shipping interfaces and Admissions, Discharges and Transfers functionality that interfaces with other software systems to enable transfer of information about patients. The software also integrates with QS/1’s popular NRx pharmacy software product. Document imaging modules help providers keep up with ABNs, delivery tickets, physician orders and other documents, and they can predefine a document type and label it to make it easier to find. The system also integrates with point of sale (POS) and with interactive voice response (IVR) systems for resupply, patient surveys, etc. “It all depends on what their needs are,” Bell says. “We offer additional modules and add-ons.” The software has added an indicator on doctor’s records to confirm that the doctor has registered with the PECOS system. (Orders from non-registered doctors will start triggering CMS edits again starting Jan. 6, 2014.) SystemOne also has added indicators of which patients are in competitive bid areas (which are subject to different allowable amounts). SystemOne can run on a server at a client’s site, or it can be hosted at QS/1’s facilities (with a backup server at a data facility). An advantage of the hosted system is that QS/1 does all the software updates in-house, Bell says.

Strategic Billing and Collections

Interfacing with other software systems, Strategic AR focuses on patient billing and collections for the DME/HME market and uses automated invoicing, past-due follow-up and a patient payment portal as tools to promote more timely payment. Kevin Winkley, president and CEO of Strategic AR, faults the use of account statements rather than invoices in the medical industry as one reason payment is often slow. A statement of account lists all the activity on an account for a specified period but may not spell out how much the patient owes. Patients often become accustomed to ignoring account statements and assume, for example, that the insurance hasn’t paid yet. Some hospital statements even say “pending insurance, do not pay.” Timely payment for DMEs may especially be an issue with monthly rentals, when payment is due every month. Instead, Strategic AR automatically sends an invoice that specifies a fast due date (20 days). After the due date (and a brief grace period), the company sends a series of past-due notices, and then automated telephone calls. Providers can interface with the system using the AR Dashboard, a web-based system that automates workflow. The dashboard shows providers payment trends and which accounts may need attention (such as a wrong address). Strategic AR receives billing downloads from other software systems, including patient and invoice detail, which is pulled into the Strategic AR database. Strategic AR also has a Web-based patient portal that allows the patient to create a profile and store his or her credit card or e-check information to easily pay DME/HME invoices online with a couple of clicks. A patient can also view his or her invoice and payment history and retrieve images of invoices. The portal can clearly communicate which bills have been paid and which are still outstanding. “Our patient portal drives the patient to more of a self-service model,” says Winkley. He says providers are most successful when they advertise availability of the portal to drive customers to use it, noting that even elderly people are becoming more computer literate in the age of Facebook. Strategic AR’s virtual agent calls use software automation and voice recognition to make collection calls to patients. In the age of Siri, voice recognition has come a long way and is especially useful when the range of possible answers is narrowed. The automated voice can ask questions, understand the answers and offer the option of a payment plan or take a Visa or MasterCard as payment for an outstanding invoice. Starting with a new release in the first quarter of 2014, Strategic AR will implement an auto-pay system that will enable HME/DMEs to adopt a 100 percent coverage model. When a patient receives service, he or she provides a credit card number to keep on file (in the computer system) for automatic payment when a bill is due. The patient will also have an option of receiving an email with a link to the bill online. HME/DME providers love the system, Winkley says. “We had a company tell us their DSO dropped 42 percent. A very large DME associated with a hospital saw their average days until collected decrease from 59.75 to 27.3, a reduction of 54 percent.”