HME and DME providers are under tremendous pressure to participate in competitive bidding and better manage audits from a myriad of government programs.

Competitive bidding is a difficult fact of life for providers. The American Association for Homecare is currently soliciting feedback on the often-painful bidding process as it urges government leaders to review and even rescind competitive bidding.

HME/DME providers are also under intense pressure to comply with numerous government audits, including Health Care Fraud Prevention and Enforcement Action Team (HEAT)/Medicare Fraud Strike Force investigations, Zone Program Integrity Contractor (ZPIC)/Program Safeguard Contractor (PSC) and Medicaid Integrity Contractor (MIC).

Comparative analytics is one way HME/DME providers can prepare for, and cope with, competitive bidding and audits. This technology offers real-time data on utilization, productivity and reimbursement.

The Promise of Comparative Analytics

Comparative analytics offers HME/DME providers a strategy for addressing the burden of competitive bidding and softens the blow of the tidal wave of government audits.

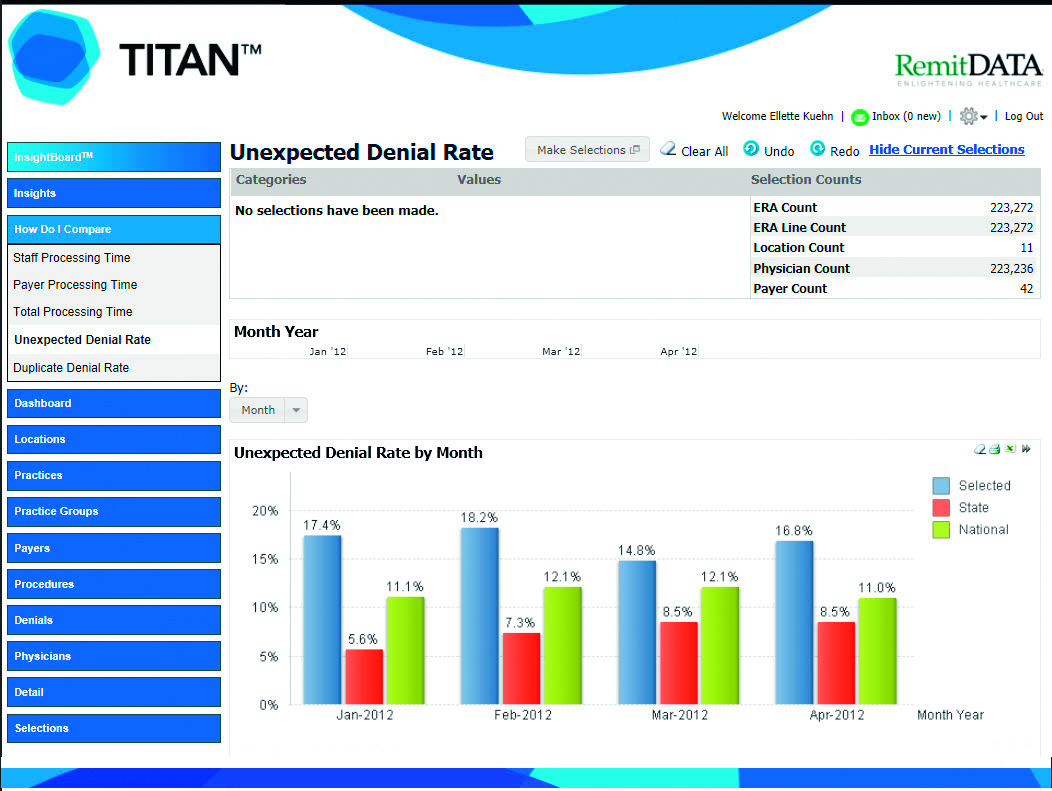

The ideal analytics solution functions in real time. It allows HME/DME providers to instantly examine and compare their performance on reimbursement, utilization and productivity against competitors. For example, a Philadelphia provider can measure and compare its performance to competitors both on the state and national levels.

HME/DME providers can easily determine whether they are outliers for RAC audits. They can discover if their competitors have higher or lower denial rates, along with faster or slower payments. They can compare their coding usage to state averages and understand how well their staff performs against peers and competitors.

While some providers may believe that such data is available from government agencies in print form, the data within these publications is sometimes at least two years old. HME/DME providers will find real-time data more beneficial. It is fast and easy to view, understand, use and share.

Consider a competitive bidding scenario: An HME/DME provider needs to understand how well it performs within a market as a bid for oxygen supplies approaches. It must have a grip on its payment history, level of staff performance and ranking among peers and competitors. Comparative analytics data helps the HME/DME provider assess the health of its business. If business health is weak, it can take steps to improve and perhaps accept lower bids. If the business is already healthy and the provider is still unable to accept lower bids, it may want to consider exiting some product categories.

In addition to helping providers understand how they rank, perform and fit within a specific market in preparation for competitive bidding, comparative analytics helps these companies achieve compliance and better manage or possibly avoid onerous audits.

Using comparative analytics, providers can easily uncover the variables that might cause them to stand out from peers and competitors, such as higher denial rates and use of specific codes to accelerated payments. Once providers identify the factors that might attract an auditor’s attention, they can proactively set real-time alerts and quickly take action to remedy underlying problems.

For example, a denial rate of 17 percent might put an HME/DME provider into an audit queue. However, these companies often have denial rates of 20 percent or more due to intake errors, incorrect patient information or insufficient data from physicians. How does the provider explain its unique situation?

Comparative analytics helps provide an answer. It tracks and provides reasons for denials, enabling providers to justify higher-than-average denial rates in the event of an audit or query. Armed with comparative analytics data, a provider can easily show an auditor that it:

- Knew about the denial rates

- Understood where it stood against competitors, and why

- Responded proactively to better manage and control denial rates

HME/DME providers can also rely on comparative analytics to track audit activities within a specific market or region. When HME providers learn that auditors are questioning higher payments, they can access, review and evaluate past and current payment data and prepare for a possible audit.

Ideally, comparative analytics solutions offer providers the same data that Medicare publishes, but doesn’t make available. The best comparative analytics tools allow providers to access data by code and market and in real time.

Find the Right Comparative Analytics Vendor

Not all comparative analytics vendors are alike. They differ in health care expertise, experience, technology and flexibility. HME/DME providers should look for those that meet these important criteria:

- Experience—Ideally, a vendor should have more than 10 years of experience in working with remittance files and structured data.

- Database size—A vendor should have data on a large percentage of HME/DME providers within the U.S., preferably 20 to 40 percent.

- Technology—A vendor needs the capacity to rapidly move data and perform comparisons. Providers can no longer afford to wait for a report to be posted on the Internet or to conduct a data pull at the end of the month. They deserve data in real time so they can set proactive alerts and take corrective action.

HME/DME providers that want to conquer competitive bidding and audit pressures should consider these strategies:

Be informed—If you truly understand how a market performs, you’ll be in a better position to compete.

Get serious—Analyze, evaluate and synthesize data using the microscope of an auditor.

Get ahead of the curve—Familiarize yourself with data before it becomes known to competitors and auditors.

Competitive bidding will not go away any time soon. As more money is spent on health care by private and public payers, scrutiny in the form of audits also will continue to increase. The promise of comparative analytics is that HME/DME providers can begin to use data to help overcome these difficulties and thrive in this increasingly aggressive market.