Profit margins of homecare companies have been subject to significant pressure recently. The loss of the companionship exemption, health insurance benefits obligations under the ACA, licensure updates and now a new overtime threshold for office staff keeps the pressure coming.

Many homecare agencies do not realize they are sitting on a pile of tax credits for caregivers they have already hired. These tax credits can boost profits 20 percent or more, and potentially counteract each of the profit-margin pressures you have been facing.

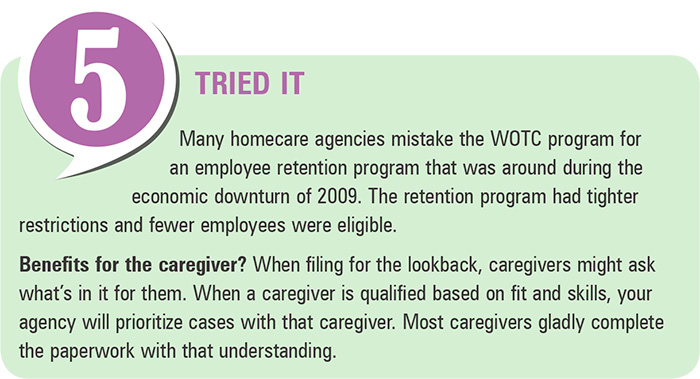

The dynamics of the Work Opportunity Tax Credit (WOTC) Program are simple. Approximately 20 percent of caregiver hires are eligible for your business to receive a tax credit between $2,600 and $9,600 per caregiver. This program was recently renewed for five years, and it encourages employers to hire and put to work targeted employees who traditionally have barriers to employment.

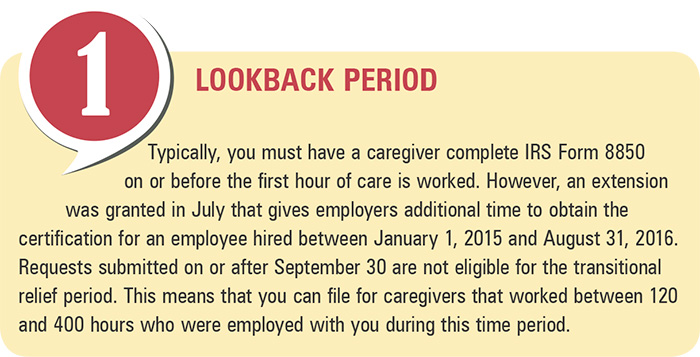

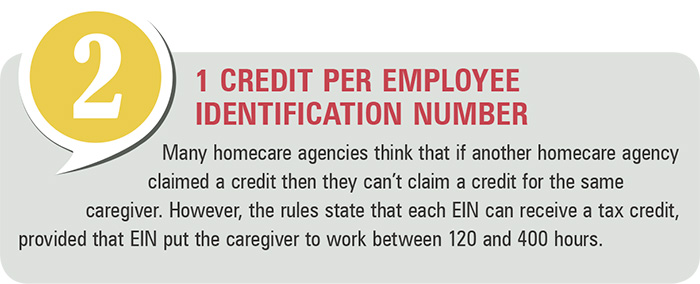

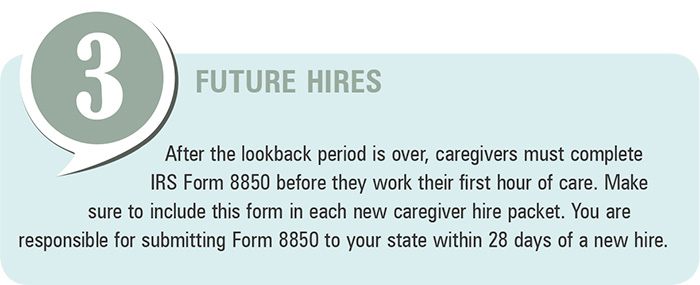

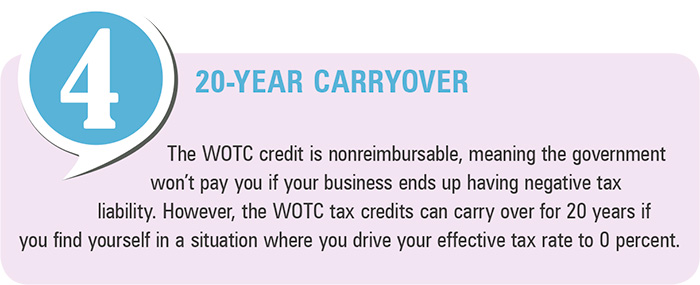

Refer to the numbered graphics for the top 5 things you need to know to get started today. Have caregivers complete IRS Form 8850 or ask your tax accountant—or, if you’re a ClearCare customer, the whole process is now built into the platform.

Not sure the program is real? Jeff Schweikert of Home Care Assistance in St. Louis wants agencies to know, “Upward of 30 percent of our caregivers are qualifying. It is an opportunity to obtain tax credits for things we were already doing with the business. Since the beginning, we have worked to help our employees access the tools and environments to become more independent. It’s been great to have the opportunities through WOTC to receive tax credits in exchange for doing the right thing in creating jobs that become careers.”

For more information, visit www.doleta.gov.